* Data from the IMF showed the pressure on debt repayment for countries denominated in the dollar has increased sharply. More than 60 percent of low-income countries are already at high risk of or in debt distress.

* While the world navigates through turbulent times, it is imperative to acknowledge China's significant role in providing a boost and stability to the global economy.

BEIJING, July 15 (Xinhua) -- "The IMF forecast for global growth over the medium-term is around 3 percent -- well below the historical average of 3.8 percent during 2000-19. Moreover, economic fragmentation will both undermine growth and make it harder to tackle pressing global challenges."

What the IMF's Managing Director Kristalina Georgieva wrote on Thursday outlined a tottering global economic recovery with "rising economic fragmentation, slow growth, and high inflation," which, in fact, has much to do with America's self-serving and irresponsible monetary and trade policies.

Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva (R, back) attends a press conference in Washington, D.C., the United States, on April 13, 2023. (Xinhua/Liu Jie)

From spawning unlimited quantitative easing measures to peddling "decoupling" and its more cunning version of "de-risking," the world's sole superpower has racked its brain to drop its domestic crisis into other's lap, bleeding its allies, fleecing developing countries, rocking global supply chains, and eventually triggering global economic volatility.

TOXIC MONETARY POLICY

To address the high inflation caused by its unlimited quantitative easing measures implemented during the pandemic and to avoid domestic economic recession, the United States has initiated a new cycle of interest rate hikes since March 2022, shifting its crisis to the world.

So far, the U.S. Federal Reserve has raised interest rates 10 consecutive times, with a cumulative increase of 500 basis points, the fastest pace of hikes since the 1980s.

The United States once again wielded its monetary policy to fleece other economies, especially emerging markets, causing global economic volatility.

A screen displays stock market information at the New York Stock Exchange (NYSE) in New York, the United States, on July 6, 2023. (Xinhua/Michael Nagle)

As early as April last year, Malhar Nabar, a division chief at the IMF's Research Department, hit the nail on the head, pointing out that the Fed's more aggressive rate hikes could add pressure to capital outflows in emerging markets, push up imported inflation, increase debt vulnerabilities and reduce policy space.

Noting that U.S. monetary policy is responsible for skyrocketing inflation in Argentina, Hernan Bergstein, an economics professor at the National University of Quilmes in Argentina, said, "U.S. interest rate hikes imply less investment worldwide and may also mean that we will have difficulties exporting our products."

Echoing Bergstein, Adel Mahmoud, chairman of Cairo Forum for Economic Researches, said the United States has been exporting its domestic crisis to other countries by taking advantage of the dollar's dominance.

Similarly, Dr. Waleed Gaballah, a member of the Egyptian Association for Political Economy, Statistics and Legislation, said the United States seeks to save its economy at the expense of the global economy through over-printing U.S. paper dollars and raising interest rates, exporting economic crises to many countries.

The words of former U.S. Treasury Secretary John Connally in 1971 ring true: "The dollar is our currency, but it's your problem."

Many countries have suffered the devaluation of their currencies, capital outflows, rising debt service costs and intensified imported inflation. Some have even fallen into a currency or debt crisis.

Data from the IMF showed the pressure on debt repayment for countries denominated in the dollar has increased sharply. More than 60 percent of low-income countries are already at high risk of or in debt distress.

Recalling the global financial crises of 1971 and 2008, both of which started in the United States, Professor Bruno Colmant, a member of the Belgian Royal Academy, said that Washington never ends its wars or pays off its debts.

"D" WORD GAMES

The United States is causing global economic instability with its toxic monetary policy. It's also using word games to manipulate international public opinion.

The economic term "de-risking" had long been criticized by the United States, the EU and the World Bank. However, some Western politicians, particularly American ones, have recently embraced the term to counter China's rise, replacing the old term "decoupling."

A change in rhetoric does not mean a difference in action. In essence, "de-risking" is hardly different from decoupling.

Under the guise of "de-risking," the United States continues forging ahead with its policy of protectionism. To further contain and suppress China, America's "de-risking" narrative has harmed its European allies and brought turmoil to the global economy.

A customer shops at a supermarket in San Mateo, California, the United States, April 12, 2023. (Xinhua/Li Jianguo)

A recent research report by an Austrian think tank estimated that if decoupled from China, Germany will see its GDP drop by 2 percent per year, equivalent to a loss of 60 billion euros (some 65 billion U.S. dollars).

Whether it's called decoupling or "de-risking," the United States is veering towards the wrong path of neo-mercantilism, said Gary Clyde Hufbauer, a nonresident senior fellow at the Peterson Institute for International Economics.

"De-risking" is putting all parties at risk, said the Singapore-based Straits Times in an opinion article, adding that the negative impact of "de-risking" economic links with China goes far beyond China, the United States and the EU but also affects other trading partners.

Those who use such intoxicated terms as rivalry, competition, decoupling or "de-risking" to describe ties with China would "risk a further decline of our economy," said Michael Borchmann, former head of the European and International Affairs Department of the federal German state of Hesse.

Keith Bennett, vice chair of Britain's 48 Group Club, shared the same view. "De-risking" is the "wrong term," he said.

Citing Britain-China trade data, Bennett stressed the figures show "how unrealistic it is to talk about ideas of decoupling or de-risking. It's a backward way of looking at the world because no country can develop sustainably and prosperously in isolation."

"The situation of slower growth in trade would be made far worse if the world were to decouple or fragment," warned Ngozi Okonjo-Iweala, director-general of the World Trade Organization.

Through word games, the United States has concealed that it is the biggest risk and source of global chaos.

CHINA'S RESILIENCE

Amidst mounting global economic uncertainties and a surge in unilateralism and protectionism, China's resilient growth injects impetus and certainty into the global economic recovery.

While experiencing a minor deceleration, China's economic growth remains strong compared to many other major economies. It bolsters domestic consumption and investment and provides a lifeline for global economic stability.

Noting that "almost 30 percent of global growth depends on the success of the Chinese economy," World Economic Forum President Borge Brende said, "China is taking many right steps to support growth. In the medium term, I'm optimistic about Chinese growth. Long-term, I'm very optimistic about China's growth."

This aerial photo shows a cargo ship at a smart container terminal of Tianjin Port in north China's Tianjin, July 7, 2023. (Xinhua/Zhao Zishuo)

Multiple international organizations also back Brende's confidence. The World Bank, the Organization for Economic Co-operation and Development and the United Nations lifted their prediction on China's economic growth, projecting that it would grow by more than 5 percent this year.

Observing that "the Chinese economy will be innovation-led and technology-led," Wilson Lee Flores, a columnist for The Philippine Star, said, "all the technological innovations will push long-term sustained economic growth of the Chinese economy."

With boosting innovation emerging as a major solution to drive global economic recovery, China collaborates on technology with over 160 countries and regions and is actively involved in more than 200 international organizations and multilateral mechanisms related to science and technology that contribute to global economic and technology innovation.

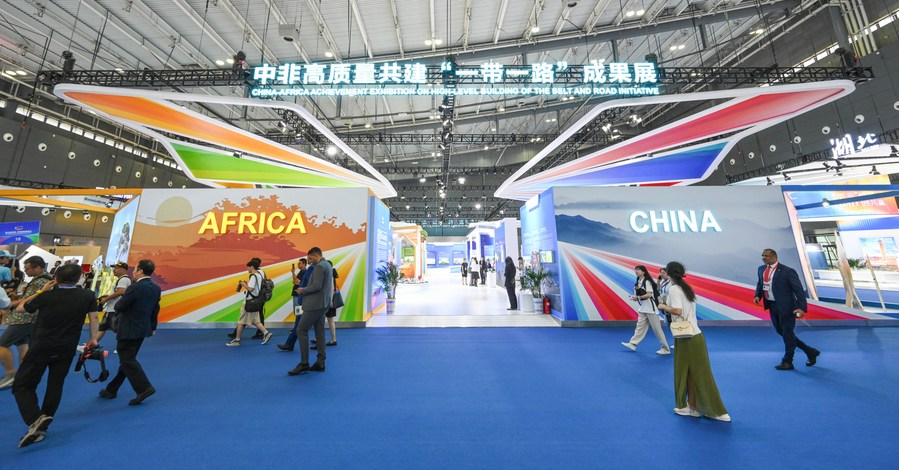

Visitors walk past the exhibition hall of the China-Africa Achievement Exhibition on High-Level Building of the Belt and Road Initiative during the third China-Africa Economic and Trade Expo at the Changsha International Convention and Exhibition Center in Changsha, central China's Hunan Province, June 29, 2023. (Xinhua/Chen Yehua)

Industry giants in multiple sectors, like automobile manufacturing giants BMW, Mercedes-Benz and Tesla, are upbeat about the prospects of the Chinese economy and have enhanced R&D investment in the country.

Ola Kaellenius, chairman of the Board of Management of Mercedes-Benz Group AG, said with its dynamic economy and a clear focus on innovation, "China is and will remain an important pillar of our long-term global strategy."

While the world navigates through turbulent times, it is imperative to acknowledge China's significant role in providing a boost and stability to the global economy.

Highlighting China as a stabilizer for the global economy, an accelerator for consumption and the world's laboratory for innovation, L'Oreal Chairman Jean-Paul Agon said, "We believe that investing in China is investing in the future."