Since the beginning of this year, Jiangsu has reported a rapid growth in its total financial volume, demonstrating excellent quality and reduced prices. Loans to the manufacturing industry have maintained a rapid growth, providing strong support for the healthy development of the real economy.

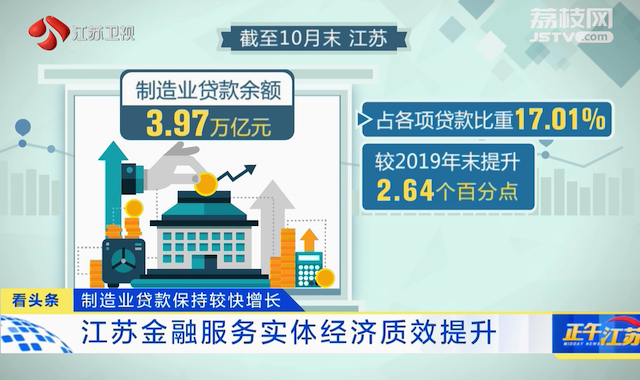

Statistics show that as of the end of October, Jiangsu recorded a manufacturing loan balance of 3.97 trillion yuan, an increase of 2.03 trillion yuan from the end of 2019, accounting for 17.01% of all loans and an increase of 2.64 percentage points from the end of 2019.

Jiangsu recorded a balance of 1.49 trillion yuan in medium and long-term loans for the manufacturing industry, accounting for 37.56% of the total manufacturing loans.

High-quality financial supply has provided a strong driving force for the transformation and upgrading of the manufacturing industry. Suzhou Wujiang-based Shangyuan Technology, a high-tech enterprise deeply engaged in the field of drinking water safety, is building an ultrafiltration membrane intelligent industrial park, subjecting itself to significant financing pressure.

The local bank provided the company with a comprehensive package of financial services and added a supply chain credit of 70 million yuan. Suppliers can obtain bank financing through electronic bills obtained from Shangyuan Technology, thereby injecting capital into the entire industry chain.

“From the initial infrastructure project loans to normal working capital loans, we have also provided them with supply chain financing products this year,” said Ding Xuefeng, Vice President of Agricultural Bank of China Suzhou Demonstration Zone Branch.

“We have been provided with tracking services to support us in completing research and development and productization, making us at the forefront of the country in segmented fields,” said Dong Jiangang, Chairman of Shangyuan Technology Group.

Since the beginning of this year, a series of policies have been introduced at the national and provincial levels to guide financial resources to increase support for key areas and enhance weak links.

In the first three quarters, Jiangsu ranked first in terms of credit issuance in the country. At the provincial level, 18 financial support measures have been introduced to support the manufacturing industry by proposing to improve financing products and services for manufacturing enterprises, carry out manufacturing loan guarantee insurance business, financing leasing business, and other support for the development of small and medium-sized enterprises.

Through equipment leasing, some small and medium-sized enterprises with weaker credit can easily obtain financing for expanding factories, upgrading equipment, and expanding production capacity.

“We mortgaged our equipment to a leasing company and rented it back for use. The equipment itself was not used, but through this process, we obtained financing to revitalize the fixed equipment,” said Li Jian, Chairman of Jiangsu Guangxing Fengmao Technology Co., Ltd.

“Financing through equipment leasing is lower and more convenient for small and medium-sized enterprises. In the first three quarters of this year, we served nearly 2000 manufacturing small and medium-sized enterprises and self-employed businesses, with a total investment of over 12 billion yuan,” said Ma Chengbin, Senior Account Manager of Jiangsu Financial Leasing Industrial Equipment Business Unit.

In September, Jiangsu recorded a weighted average interest rate of 3.87% and 4.06% for newly issued corporate loans and inclusive small and micro loans, respectively, with a year-on-year decrease of 17 and 50 basis points, at historical lows.